Foreign investors Segantii India Mauritius, Norges Bank, and Aberdeen Standard Asia Focus bought a total of 2.53 percent equity stake in FSN E-Commerce Ventures, the operator of multi-brand beauty retailer Nykaa, via open market transactions on November 10, the ex-bonus day.

Nykaa shares rallied more than 6.5 percent to close at Rs 188 on the NSE amid large volumes. The stock largely recouped all its losses seen in the previous session ahead of the expiry of the one-year lock-in period ending on November 10 for its pre-IPO investors.

Overall it was down 56 percent from its record high in November last year, though it was rangebound in the current month.

The stock traded ex-bonus on November 10, ahead of its record date for the bonus issue which was revised by the board of directors later, to November 11 from November 3 earlier. The company will issue five bonus shares for every equity share held by shareholders.

Also read: The good, bad and ugly of Nykaa’s bonus issue

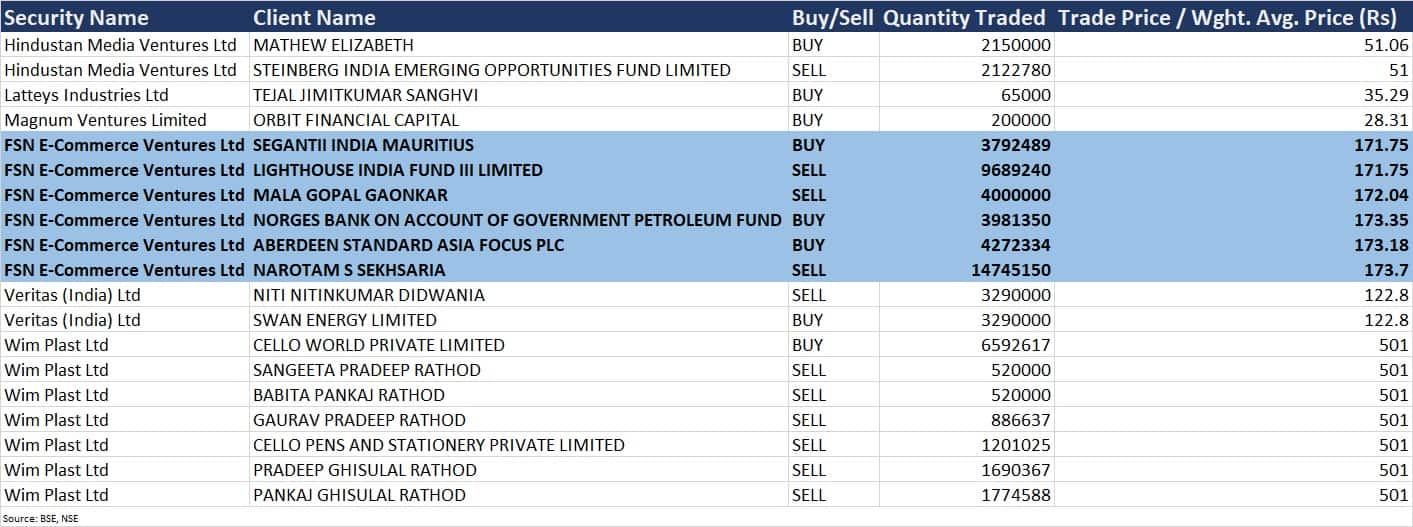

Segantii India Mauritius acquired 37.92 lakh shares at an average price of Rs 171.75 per share, Norges Bank on account of Government Petroleum Fund bought 39.81 lakh shares at an average price of Rs 173.35 per share, and Aberdeen Standard Asia Focus Plc purchased 42.72 lakh shares at Rs 173.18 per share.

However, high-networth individual Narotam S Sekhsaria, founder of Ambuja Cement, partially exited the company by selling 1.47 crore shares in Nykaa at Rs 173.7 per share. This is the entire holding he held before the bonus issue. He has not liquidated bonus shares which are yet to be credited.

Also read: Nykaa lock-in period ends today, setting 67% shares free to trade

Lighthouse India Fund III also sold 96.89 lakh shares (2.04 percent stake) of the online fashion retailer at an average price of Rs 171.75 per share, and Mala Gopal Gaonkar offloaded 40 lakh shares at an average price of Rs 172.04 per share.

Mala Gopal Gaonkar held a 2.4 percent stake or 1.13 crore shares in Nykaa as of September 2022.

Among other deals, foreign portfolio investor Steinberg India Emerging Opportunities Fund exited Hindustan Media Ventures by selling the entire 21.22 lakh shares in the company at an average price of Rs 51 per share.

However, investor Mathew Elizabeth acquired 21.5 lakh shares in Hindustan Media at an average price of Rs 51.06 per share.

Promoter Niti Nitinkumar Didwania sold another 32.9 lakh shares in Veritas (India) at an average price of Rs 122.8 per share. Swan Energy was the buyer in this deal.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.